Contents:

This will confirm the validity of your shooting star on the chart. Click the ‘Open account’button on our website and proceed to the Personal Area. This procedure guarantees the safety of your funds and identity.

- However, even with confirmation, there is no guarantee that the price will continue to fall, or how far it will go.

- That is to say that the upper wick of this candle is very prominent in comparison to the lower wick.

- Like the Inverted hammer it is made up of a candle with a small lower body, little or no lower wick, and a long upper wick that is at least two times the size of the lower body.

- A hammer candlestick pattern is almost identical to a shooting star.

- Nevertheless, there are cases where the price rises after the shooting star candle emerge.

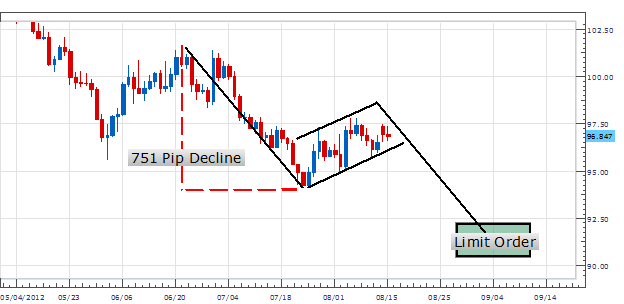

We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. The first blue arrow on the image measures the size of the candlestick. According to our shooting star trading strategy, we should seek a target equal to three times the size of the pattern.

It is a reversal pattern that is most often seen after a price rise. It’s a powerful pattern that will often call market tops, and the end of rallies within an overall downtrend. The price action moves higher again in the session, fails to create a new high, and reverses to close at the low of the session.

Advantages and disadvantages of shooting star pattern

However, it is still important to couple it with fundamental and technical analysis. However, if you use the strategies mentioned above, you will be at a good position to avoid risking too much money. The region below its real body should also have a small or no shadow. The essence of this strategy is the opening and closing of trades during intraday trading. In this section, you will see examples of the formation of a shooting star on the USDCHF daily chart.

Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts. If you are interested in trading using technical analysis, have a look at our reviews of our recommended brokers to learn which tools they offer. When the market found the area of resistance, the highs of the day, bears began to push prices lower, ending the day near the opening price. The bulls, however, could not maintain the price move higher, as sellers came in and overwhelm the buyers with their supply-side orders. This leads to a sharp move lower as the sellers are the ones that are truly in control of the market during this time.

Shooting star trading strategy

In this article, we are going to cover all the basics you need to know in order to start using and identifying the shooting star candlestick pattern in forex trading. You should always use a stop-loss order when trading the shooting star candle pattern. After all, nothing is 100% guaranteed in stock trading, and you may experience false signals when trading the shooting star pattern. The shooting star is a single bearish candlestick pattern that is common in technical analysis.

Secondly, the open and close of the candle should occur near the bottom one third of the price range. And also, the body of the shooting star formation should be relatively small. If we analyze our shooting star formation here, we can see that all of these important guidelines have been met. As such, we can confidently label this candlestick as a shooting star pattern.

Commodity.com makes no warranty that its content will be accurate, https://g-markets.net/ly, useful, or reliable. Mr. Pines has traded on the NYSE, CBOE and Pacific Stock Exchange. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives.

How to trade the hammer and inverted hammer candlestick pattern – FOREX.com

How to trade the hammer and inverted hammer candlestick pattern.

Posted: Wed, 16 Nov 2022 08:00:00 GMT [source]

In the example above, we have added a volume indicator to the forex shooting star’s lower panel and marked the volume bars directly below the red confirmation candles with ovals. Note the volume increase directly following the shooting star candles. The Shooting Star is a candlestick pattern to help traders visually see where resistance and supply is located. In fact, there was so much resistance and subsequent selling pressure, that prices were able to close the day significantly lower than the open, a very bearish sign.

Key tips about shooting star candlestick pattern

While the body shows the opening and closing prices of the given timeframe, the wick shows us where the price was within the timeframe. The position and formation of the candlestick give us either a bullish or a bearish signal. First of all, you open the chart and try to find a shooting star. Once you’ve noticed the formation of the shooting star, you should wait for the next candlestick to move below the low of the shooting star you’ve just found. You need to do that to make sure the candlestick pattern confirms itself. The perfect market entry will be exactly at the time when this confirmation happens.

It is worth noting that a shooting star pattern is not always a sign that a financial asset will reverse and start a new bearish trend. In a shooting star pattern, the long upper shadow is usually a sign of people who bought early and are now in a loss-making position since the price slipped back to the opening. On top, this pattern is quite reliable with the support of other reversal patterns. However, a shooting star can give false signals in an uptrend at higher volumes.

It is a bearish candlestick pattern characterized by a long upper shadow and a small real body. The pattern forms when a security price opens, advances significantly, but then retreats during the period only to close near the open again. Consequently, the open and close price points are close to one another.

What Is The Shooting Star Candlestick?

Partnerships Help your customers succeed in the markets with a HowToTrade partnership. Trading analysts Meet the market analyst team that will be providing you with the best trading knowledge. Trading academy Learn more about the leading Academy to Career Funded Trader Program. Stay in the know with the latest market news and expert insights delivered straight to your inbox. There is no more efficient way of doing that than in a trading simulator with a realistic trading environment.

While the candlestick formation implies potential reversal prospects, it cannot be used in isolation to make a trading decision. Once the Shooting Star emerges, it is important to wait for a conformation candle to be sure a reversal is in play. The next candle should be bearish and appear on heavy volume to ensure that bears have overpowered bulls and are set to push prices lower. The shooting star candlestick consists of a long upper shadow and a small body near the bottom.

How to trade with a shooting star candle?

To identify a perfect shooting star candlestick pattern, I will explain this candlestick in three stages. The shooting star pattern consists of two candlesticks with a small gap between them. The pattern signals the increased influence of the bears and the imminent reversal at the top. There are several ways to trade a shooting star candlestick pattern. You should consider whether you can afford to take the high risk of losing your money.

This gives us a strong bearish signal and we short Apple at the end of the bearish candle. At the same time, we place a stop loss order at the highest point of the shooting star – above the upper candlewick. Suddenly, a shooting star candlestick appears, which is marked with the green circle on the chart.

- In this case, traders can look to enter short positions to profit as prices correct from the previous highs to new lows.

- A dragonfly doji is a candlestick pattern that signals a possible price reversal.

- In other words, the wick doesn’t have to point in the opposite direction of the new trend.

- The shooting star reversal candlestick boasts a success rate of about 69% when predicting bearish reversals from an uptrend.

- However, other indicators should be used in conjunction with the Shooting Star candlestick pattern to determine potential sell signals.

With the obtained information, a trader is able to make subjective decisions on the direction of the asset. After determining the top and the pattern itself, it is necessary to wait for confirmation of a trend reversal. The breakout of the lower border of the ascending channel and the retest confirm that the market turned bearish. The first shooting star pattern was formed, then the price bounced off the lower border of the ascending channel with an impulse green candle.

One needs to use fundamental and/or technical analysis to confirm the pattern’s predictions. As a trader, it is fairly easy to determine your next move by using this pattern. With reference to the chart above, the expected effect is lower prices. Another similar candlestick pattern in look and interpretation to the Shooting Star pattern is the Gravestone Doji. The long upper shadow of the Shooting Star implies that the market tested to find where resistance and supply was located. The upper red line shows our stop-loss, which is around 20 pips above the session’s high.